An interesting thing has happened over the last 12 months in the US stock market. A handful of large companies carried the index to new highs while most stocks lagged; over the last year (far right of the chart) over 10% of the stocks in the S&P 500 did better than the broad index itself. In other words, 90% of stocks lagged the performance of the entire index. That seems impossible given that the index is simply the collective average performance of the stocks that make up the index.

It's only possible because the S&P 500 index is “market-cap weighted” meaning the larger companies (e.g., Apple, Amazon, Microsoft) carry a much larger weighting than smaller companies. Apple’s weight in the index is 5.67%. Walgreens, for comparison, has a weighting of 0.03% (making it the 425th largest weighting). That means that Apple is nearly 200 times larger than Walgreens. Walgreens could fall 50% and barely impact the broad index… which is essentially what happened last year. The larger companies with the heaviest weighting did excellent in 2023, trouncing the remaining stocks in the index.

Why have the larger companies done so much better than everyone else? The earnings expectations for those larger companies have trounced the expected earnings growth rate for the rest of the market. See the chart below. This shows the expected earnings (per share) for the “Magnificent 7” (the term coined to describe some of the largest stocks) compared to the rest of the market. As you can see the expectations are that the “Magnificent 7” will post notably better earnings growth than the rest of the market. The gap in the expected earnings growth for the remaining 493 other companies in the S&P 500 is a tad concerning as explains why investors continue to bid up the shares in the largest companies. But high expectations can be a hard hurdle to meet.

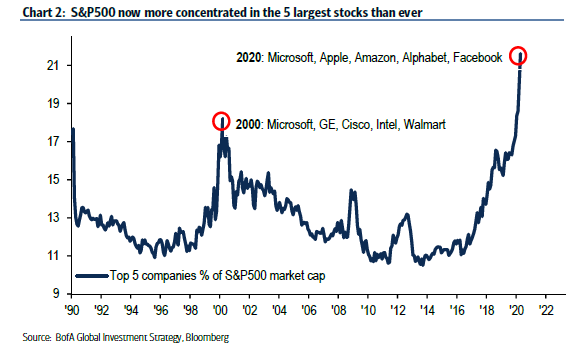

We’ve seen concentration like this before, but it’s rare. The last time we saw this level of concentration in the market was during the dot com peak, when investors could not get enough of Microsoft, Cisco, and Intel, GE and Wal-Mart in the late 1990s and early 2000s.

Those five stocks didn’t fare well over the next years. From January 1, 2000, to January 1, 2005, the cumulative performance for the top 5 stocks were approximately:

Microsoft: -48%

GE: -22%

Intel: -45%

Wal-Mart: -18%

Cisco: -63%

It’s not that those companies had declining sales during that time or even that they didn’t increase their earnings or even grow their market share, it’s simply a matter of expectations. At some point, results fail to meet investor expectations and stock prices struggle to live up to the hype.

It’s also worth noting that leaders generally haven’t stayed on top of the pile for long.

Concentration in the market doesn’t spell doom and gloom for the market. The saving grace could be a “broadening out” of performance in which other (smaller) stocks begin to outperform the larger concentrated ones. As of the last month, 52% of stocks in the S&P 500 were performing better than the broad index (a good thing in my opinion and a far cry from the 10% outperformance over the last 12 months).

The takeaway: I would caution investors from blindly following the crowd and adding heavily to the concentrated names at the top. History has shown us plenty of examples where market leaders fall from grace. It’s all about expectations, and right now expectations seem mighty high for the largest leaders.